Battery Pack Construction Techniques

- The electric vehicle industry is experiencing a fundamental transformation in how batteries are manufactured and integrated into vehicles.

- Traditional module-based approaches are giving way to revolutionary integrated designs that promise higher energy density, lower costs, and better performance.

- This shift represents one of the most significant manufacturing innovations since the assembly line, with companies like Tesla, BYD, and CATL leading a complete reimagining of battery production.

Types of Battery Pack Manufacturing

Understanding these four distinct manufacturing approaches

- Module to Pack,

- Cell to Pack,

- Cell to Chassis, and

- Module to Chassis

is crucial for anyone entering the rapidly evolving EV industry

- Each method represents different levels of integration and engineering trade-offs, from the proven flexibility of traditional approaches to the cutting-edge structural integration of chassis-mounted systems.

- The choice between these approaches affects everything from manufacturing costs and vehicle range to repair procedures and safety considerations.

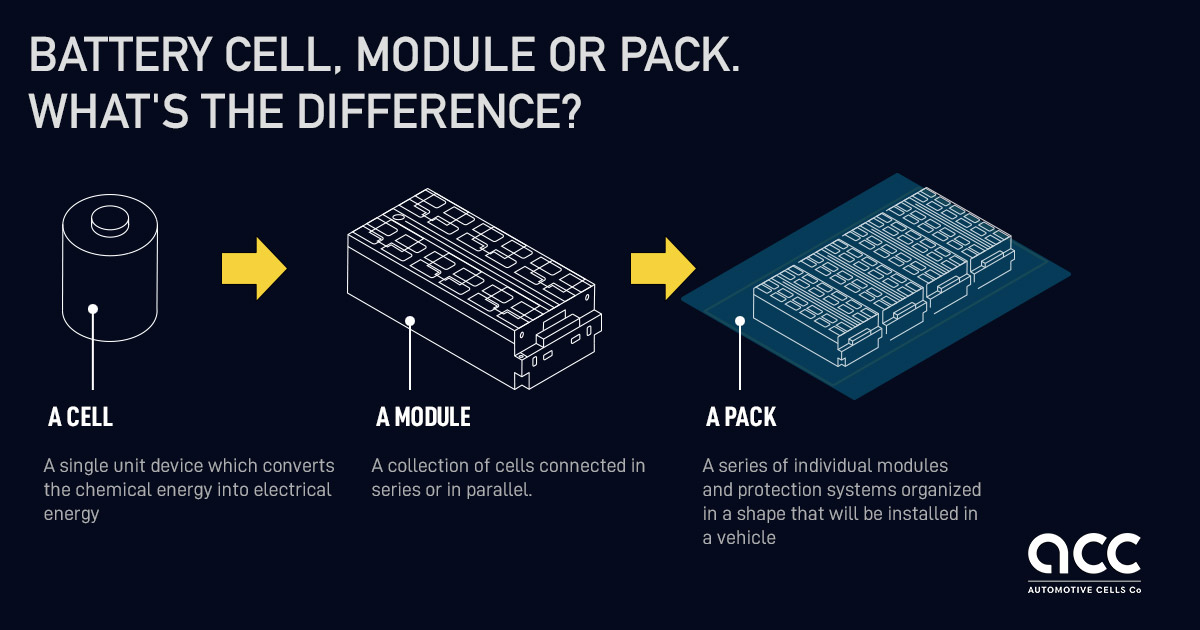

The building blocks of battery integration

- Before diving into specific manufacturing approaches, it's helpful to understand the basic hierarchy of battery systems.

- Think of it like Russian nesting dolls: individual battery cells are the smallest units that store energy, similar to AA batteries but much larger and more powerful.

- Multiple cells are typically grouped into modules for easier handling and management.

- These modules are then assembled into complete battery packs that power the vehicle.

- Finally, these packs must be integrated into the vehicle's chassis or body structure.

- The four manufacturing approaches we'll explore differ primarily in which levels of this hierarchy they eliminate or combine.

- Traditional methods maintain all levels, while the most advanced approaches integrate cells directly into the vehicle structure, eliminating intermediate steps entirely.

1. Module to pack

- The Module to Pack approach represents the automotive industry's first successful method for mass-producing EV batteries.

- Like building with standardized bricks or LEGO blocks, this method assembles individual cells into standardized modules, then combines these modules into complete battery packs.

How module to pack manufacturing works

- The process begins with individual cell preparation, where each battery cell undergoes rigorous quality testing including voltage measurement, internal resistance testing, and capacity verification.

- Think of this like sorting apples by size and quality before packing them into boxes.

- Cells are cleaned, often using laser cleaning systems, and sorted into groups with similar characteristics to ensure balanced performance.

Importance of Cell Sorting and Balance

- It is important in any battery pack that all cells have very similar capacity and internal resistance

- If the values have a big difference between themselves, certain cells will charge fast, this will cause the BMS to stop charging process to prevent these cells from overcharging

- But the other cells have not been fully charged and hence actual charge in the battery is less than the capacity at full charge

- This results in the battery charging to stop at a charge level that is lower than expected

- Just as certain cells charging faster, imbalance in the cell capacity and internal resistance will cause certain cells to discharge fast

- As these cells reach their cut off voltage, the BMS will cut off output from the entire pack to prevent deep discharging of the cells at cut off voltage

- But, a lot of cells might still be well above their cut off voltage, there is still a lot of usable charge left in the battery, but it will be unable to discharge it.

Module Assembly

- It follows a precise sequence.

- Cells are stacked into predetermined arrangements—typically 8 to 16 cells per module—with alignment tolerances of just 0.5 millimeters.

- The cells are then electrically connected using specialized welding techniques, with ultrasonic, laser, or resistance welding joining the tabs to copper or aluminum busbars.

- Each module receives its own protective housing, similar to how individual gift boxes are placed inside a larger shipping container.

- These housings include mounting points, cooling channels, and electrical connectors.

- A small computer called a Cell Sensing Circuit monitors each module's voltage and temperature, acting like a digital thermometer and voltmeter combined.

- This Cell Sensing Circuit will then later connect to the BMS of the battery pack

Pack assembly

- It integrates these completed modules into the final battery system.

- Modules are secured within a larger structural housing, connected to the main cooling system, and linked to the central Battery Management System (BMS)—the "brain" that coordinates all battery operations.

- The individual models are connected in series and parallel combinations to create the final pack voltage and current capacity.

Real-world implementations and examples

Ford's F-150 Lightning

- This vehicle uses the traditional module construction, using LG Energy Solution modules in a 131 kWh pack.

- Each module contains prismatic cells in a robust aluminum housing box.

- However, this approach revealed some challenges when Ford recalled certain 2022-2024 models due to module-level failures affecting approximately 4% of units.

- However repairing module to pack systems is easier and cheaper as only the faulty pack is to be replaced instead of the entire pack

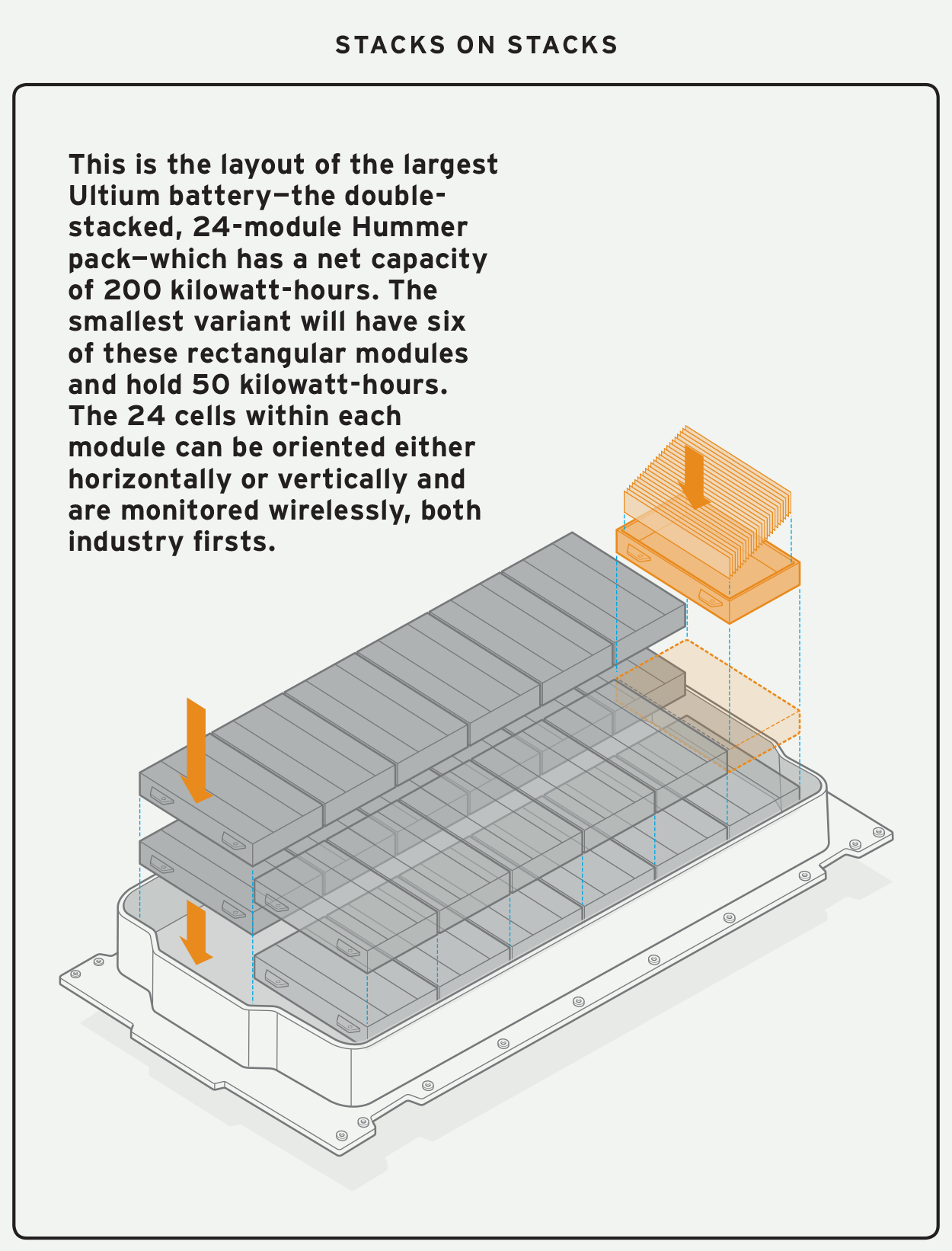

General Motors' Ultium platform

- This platform demonstrates another modular approach, with standardized modules that can be arranged in different configurations across multiple vehicle models.

- This flexibility allows GM to use the same basic module design in everything from the Cadillac Lyriq SUV to the GMC Hummer EV pickup.

Global Market

- The approach dominates US and European markets, representing an estimated 40-50% of global EV battery production.

- Panasonic continues supplying Tesla with 2170 cylindrical cells arranged in modular configurations for older Model S and X vehicles, though Tesla has transitioned newer models to more integrated approaches.

Advantages and trade-offs

- The primary strength of modular manufacturing lies in its serviceability.

- When a single cell fails, technicians can replace just the affected module rather than replacing an entire battery pack.

- This modularity also enables manufacturers to use identical modules across different vehicle platforms, achieving economies of scale.

- However, this approach carries significant weight and space penalties.

- Module housings, end plates, and structural components consume valuable space and add weight.

- The overall space utilization efficiency reaches only about 40%, meaning that 60% of the battery pack volume is occupied by non-energy-storing components.

- This directly translates to reduced vehicle range and increased manufacturing costs.

- Manufacturing complexity also increases with multiple assembly stages.

- Each module requires separate welding, testing, and housing operations before pack-level assembly begins.

- While this provides natural breakpoints for quality control, it also increases production time and requires more complex supply chain coordination.

2. Cell to pack

- Cell to Pack technology represents the industry's first major departure from traditional approaches by eliminating modules entirely.

- Instead of building cells into modules and then into packs, CTP directly integrates cells into the final battery pack structure.

- This is like removing the individual cereal boxes and pouring different cereals directly into sections of a large container.

The technical innovation in CTP

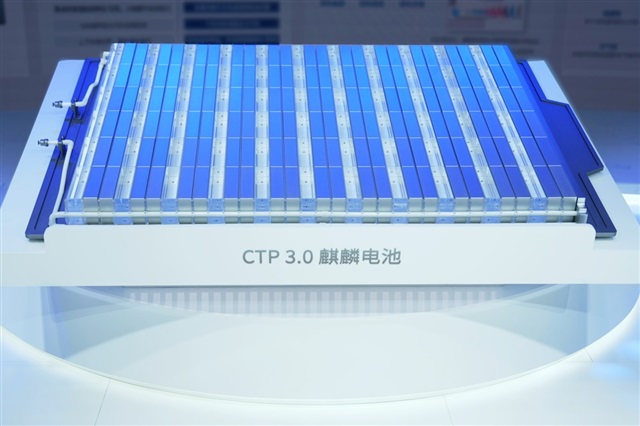

- CATL's CTP 3.0 technology, marketed as the Qilin or Kirin battery, exemplifies advanced CTP implementation.

- The system arranges large prismatic cells or blade cells directly within the pack structure, with sophisticated cooling plates providing thermal management for each cell.

- Advanced thermal interface materials replace the thermal barriers that modules previously provided.

Cell to Pack Manufacturing Process

- The assembly process begins with large cooling plates—essentially aluminum or steel trays with integrated cooling channels—welded to create the pack's foundation.

- Cells are placed directly into precision-machined slots, with tolerances maintained to within 0.2 millimeters.

- Steel strapping systems apply controlled compression forces across the entire cell array, managing the expansion forces that can exceed 20,000 Newtons in large packs.

- Electrical connections require extended busbars that span multiple cells in series, similar to wiring Christmas lights where removing one bulb affects the entire string.

- This necessitates higher precision in manufacturing and more sophisticated Battery Management Systems to monitor individual cells without module-level buffering.

Real-world implementations and examples

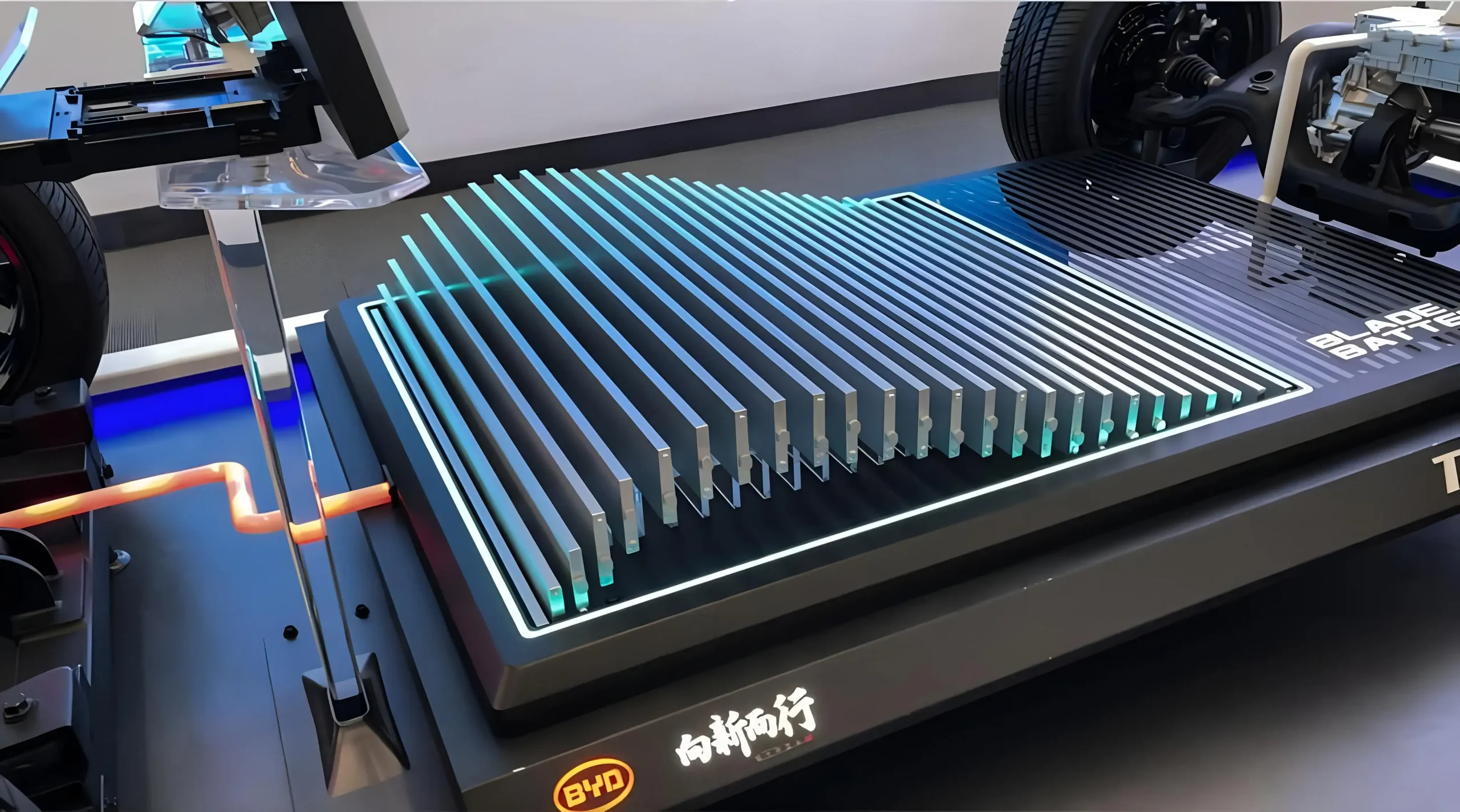

BYD's Blade Battery

- Launched in 2020 as one of the first commercially successful CTP implementations.

- The blade-shaped lithium iron phosphate cells are arranged like books on a shelf, creating both the battery function and structural support.

- BYD has built 17 production facilities with 460 GWh of planned capacity, supplying not only their own vehicles but also Tesla's Shanghai production and other manufacturers.

CATL CTP 3.0

- With a 37% global market share, supplying batteries to Tesla's Model 3 in China, various NIO models, and multiple other manufacturers.

- Their CTP technology evolved through three generations: CTP 1.0 (2019), CTP 2.0 (2021), and CTP 3.0 (2023), each improving energy density and manufacturing efficiency.

Tesla

- Tesla's transition to CATL CTP batteries for China-produced Model 3 vehicles demonstrates the technology's commercial viability.

- The switch enabled cost reductions while maintaining performance, though it required adjustments to the vehicle's thermal management systems.

- By 2023, CTP technology achieved 48.6% market penetration in new energy vehicles, representing a dramatic shift from just 13% in 2021.

- This rapid adoption reflects both technological maturity and compelling economic advantages.

Performance improvements and challenges

- CTP technology delivers substantial energy density improvements, with CATL's Qilin battery achieving 255 Wh/kg for ternary (NMC) chemistry and 160 Wh/kg for lithium iron phosphate (LFP).

- This represents a 10-20% improvement over traditional modular approaches, directly translating to increased vehicle range.

- Space utilization improves dramatically, jumping from 40% efficiency in traditional packs to 55-72% in CTP systems.

- This means more battery capacity fits in the same physical space, or the same capacity requires less space—crucial for vehicle packaging efficiency.

- Manufacturing costs decrease by 10-15% compared to traditional approaches due to the elimination of module housings, connectors, and assembly steps.

- CATL reports 50% improvements in production efficiency, with assembly lines achieving over 85% automation rates and greater than 99% first-pass yields.

- However, CTP introduces significant serviceability challenges.

- When individual cells fail, the entire pack typically requires replacement, increasing service costs from a single cell to complete pack replacement.

- Future developments include clip-on connection systems that may enable single-cell serviceability, but current implementations generally require pack-level service.

- Safety considerations become more complex without module-level barriers.

- Thermal runaway events can potentially propagate more easily across the entire pack, requiring advanced thermal interface materials and sophisticated fire suppression systems.

- This risk is mitigated somewhat by using stable chemistries like lithium iron phosphate, which are inherently less prone to thermal runaway.

3. Cell to chassis

- Cell to Chassis represents the most radical departure from traditional battery manufacturing, integrating battery cells directly into the vehicle's structural framework.

- Instead of building a separate battery pack that bolts into the vehicle, the chassis itself becomes the battery container.

- This is like building the engine block and transmission case as one integrated component rather than separate units bolted together.

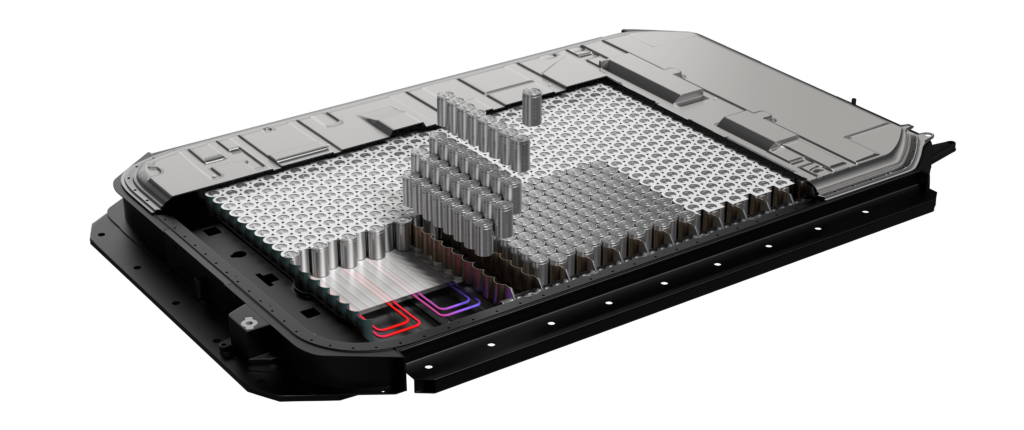

First Mass Production Chassis to Cell Battery Pack

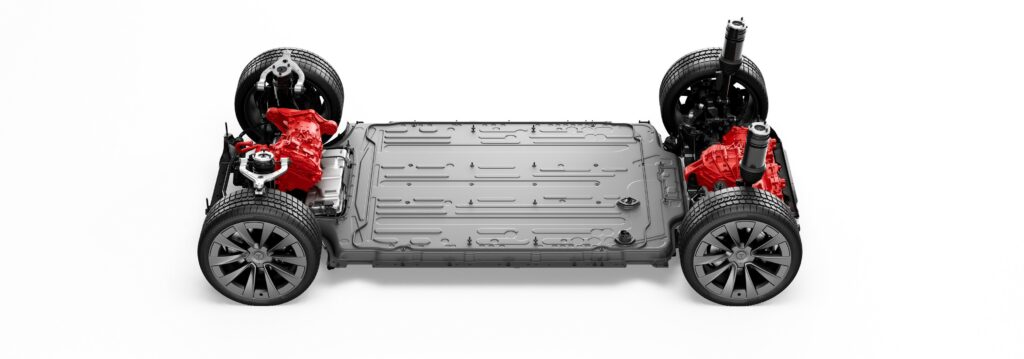

- Tesla's structural battery pack, was one of the first examples of a mass produced cell to chassis vehicle

- It was implemented in the Model Y at Gigafactory Texas

- The vehicle's underbody serves as the battery container, with 4680 cylindrical cells arranged in a honeycomb pattern directly bonded to the chassis structure using structural adhesives.

- The traditional floor panel between the battery and passenger compartment is eliminated, with cells mounted directly beneath the cabin.

- This integration requires precise manufacturing coordination between battery and vehicle production. The chassis must be complete before cell installation, and any defects during battery assembly can potentially scrap the entire chassis structure.

- Tesla reports that this approach eliminates 370 parts from the vehicle structure while reducing manufacturing costs by 7% and capital investment by 8%.

Manufacturing process and technical requirements

- The CTC assembly process begins with chassis frame preparation, where the vehicle underbody is precision-machined to create cell mounting locations.

- Unlike traditional approaches where batteries are assembled separately, CTC requires cells to be individually placed into the chassis structure using robotic placement systems with extremely high precision.

- Structural adhesives replace mechanical fasteners, bonding cells directly to chassis components.

- These adhesives must provide both electrical insulation and structural strength, handling crash forces while preventing electrical short circuits.

- The selection of adhesive materials becomes critical, as they must maintain properties across temperature ranges from -40°C to +60°C while withstanding years of thermal cycling.

- Thermal management presents unique challenges, as heat must be dissipated through the chassis structure rather than dedicated cooling plates.

- Tesla's implementation uses a side cooling methodology where cooling lines run alongside cell arrays, requiring careful thermal modeling to prevent hot spots.

Real-world implementations and examples

Leapmotor

- They introduced their CTC 1.0 technology in April 2022 with the C01 sedan, followed by CTC 2.0 in 2023.

- Their approach combines the battery tray frame with vehicle body beam structures, creating what they call a "dual-frame circular beam" design.

- This provides 25-33% improvement in torsional stiffness while reducing parts count by 20%.

- While the pack is integrated into the chassis directly, this design still uses modules to create the pack.

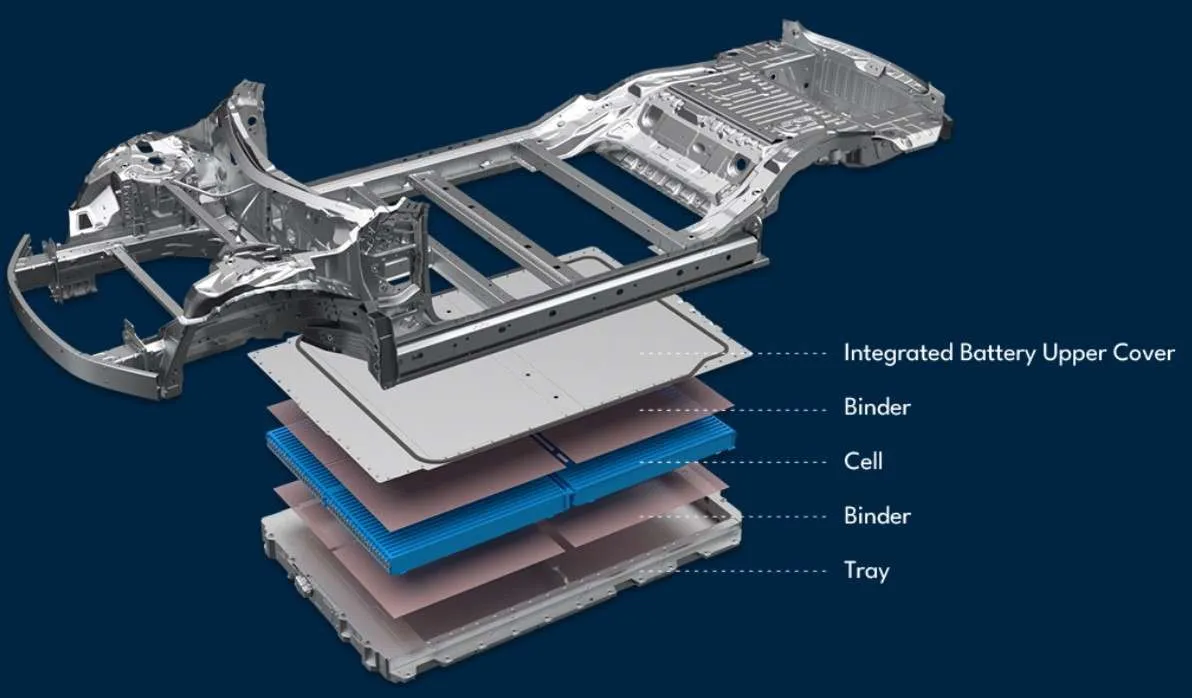

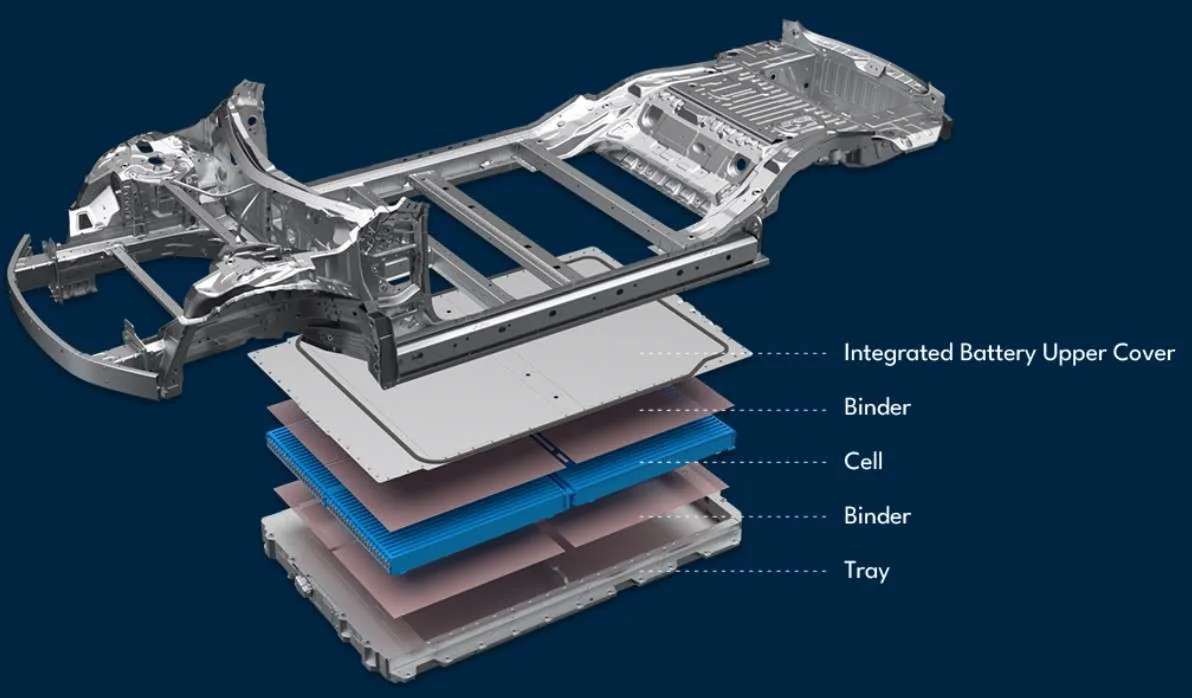

BYD's Cell to Body (CTB)

- The technology, launched in May 2022 with the Seal sedan, represents a variation of CTC.

- Their approach integrates blade batteries with the vehicle body structure while maintaining some separation from the chassis.

- This achieves 66% volume utilization while providing 45% reduction in side collision intrusion.

Xpeng's "Fuyao" architecture

- It uses CIB (Cell-in-Body) technology where the battery upper cover serves as the vehicle floor panel, saving 5% vertical interior space while maintaining structural integrity.

Structural and performance benefits

- CTC integration provides substantial structural advantages.

- The battery cells contribute to vehicle torsional stiffness, with some implementations achieving over 40,000 Nm/degree of torsional rigidity.

- This improves handling characteristics and allows for lighter chassis construction in other areas.

- Weight reduction reaches 10-15% at the vehicle level through elimination of redundant structural components.

- Tesla reports 14% range improvement in CTC-equipped Model Y vehicles, combining the effects of weight reduction and improved space utilization.

- Crash performance can actually improve with proper design. BYD's CTB implementation demonstrates 45% reduction in side pillar intrusion during side impact crashes, as the distributed battery structure helps absorb and redirect impact forces.

Challenges and limitations

- Serviceability represents the most significant challenge.

- Battery service requires chassis disassembly, making repairs extremely expensive and time-consuming.

- Some industry analysts describe CTC implementations as "impossible to service" under current designs, pushing the industry toward developing more serviceable versions.

- Manufacturing complexity increases substantially, requiring coordination between battery and vehicle production lines.

- The sequential nature of CTC assembly—chassis must be complete before cell installation—limits production flexibility and can create bottlenecks.

- Safety validation becomes more complex, as traditional crash testing must now account for battery integration.

- Fire suppression systems must be integrated into the chassis structure, and thermal barriers must prevent heat transfer to passenger compartments during thermal events.

4. Module to chassis

- Module to Chassis manufacturing attempts to capture benefits of chassis integration while maintaining some advantages of modular construction.

- Think of it as a compromise solution—like building standardized room modules that are then integrated directly into a building's structure rather than separate apartments connected by hallways.

Technical implementation approach

- The MTC approach retains traditional cell-to-module assembly but eliminates the separate pack housing by mounting modules directly into the chassis structure.

- This creates what Leapmotor calls a "dual-frame circular beam" where the battery tray frame combines with vehicle body beam structures to provide both battery containment and structural support.

Typical Manufacturing Process

- Manufacturing process begins with conventional module assembly, maintaining the proven advantages of modular quality control and testing.

- However, instead of installing modules into a separate pack housing, they're mounted directly into precision-machined locations within the chassis frame.

- Thermal management requires additional insulation layers between chassis and battery cells, as modules must be protected from chassis heat sources like exhaust systems and road-generated thermal loads.

- This adds manufacturing complexity but provides better thermal isolation than full CTC integration.

Limited commercial implementation

- Currently, MTC has limited industry adoption compared to other approaches.

- Most manufacturers pursuing chassis integration choose to implement full CTC systems to maximize benefits, viewing MTC as an intermediate step rather than a final destination.

- Some manufacturers explore hybrid approaches that combine elements of MTC with other technologies, but these remain largely experimental or application-specific rather than broad commercial implementations.

Advantages and trade-offs

- MTC provides better serviceability than full CTC while achieving some integration benefits.

- Individual modules can potentially be replaced without complete chassis disassembly, though access remains more complex than traditional pack-level service.

- Manufacturing complexity falls between traditional and CTC approaches.

- Module assembly remains standardized, but chassis integration requires additional coordination and specialized mounting systems.

- The approach delivers moderate improvements in space utilization and structural integration without the extreme challenges of full CTC implementation, making it potentially attractive for manufacturers seeking gradual transition from traditional approaches.

Comparative analysis: Understanding the trade-offs between each Pack Construction Techniques

Energy density progression

3. Traditional Module to Pack

- These systems achieve 120-150 Wh/kg at the pack level with 40% space utilization efficiency.

- The multiple housing levels and structural components consume significant volume and weight.

2. Cell to Pack

- The technology dramatically improves performance, reaching 200-255 Wh/kg with 55-72% space utilization.

- CATL's CTP 3.0 represents the current pinnacle of this approach, with energy densities approaching those of individual cells.

1. Cell to Chassis

- It achieves the highest theoretical energy density by eliminating all non-essential components, though actual implementations vary.

- Tesla reports 10% vehicle weight reduction and 14% range improvement, representing substantial real-world benefits.

Manufacturing cost implications

- Cost analysis reveals interesting patterns across approaches.

- Traditional modular manufacturing has the highest component count but benefits from established supply chains and proven processes. CTP technology reduces costs by 10-15% through component elimination and manufacturing simplification.

- CTC implementation shows paradoxical cost characteristics—Tesla reports 7% lower unit costs and 8% lower capital investment, but this requires substantial upfront engineering investment and specialized production equipment.

- The break-even point depends heavily on production volume and manufacturing scale.

Safety and thermal management evolution

- Safety complexity increases with integration level.

- Traditional approaches provide natural fire breaks between modules, limiting thermal runaway propagation.

- Each integration level reduces these barriers while requiring more sophisticated thermal management systems.

- Thermal management evolves from simple module-level cooling plates to complex integrated systems.

- CTC requires the most sophisticated thermal modeling and management, as heat dissipation must occur through chassis structures not originally designed for thermal loads.

Maintenance and lifecycle considerations

- Serviceability presents the biggest trade-off between approaches.

- Traditional modular systems enable granular or very targeted repair—individual modules can be replaced.

- CTP systems typically require entire pack replacement.

- CTC systems may require chassis-level disassembly, making some repairs economically impractical.

- Future developments focus on addressing these serviceability challenges.

- Emerging clip-on connection systems may enable single-cell replacement in CTP systems, while CTC designs explore improved access panels and modular chassis sections.

Industry trends and manufacturer strategies

Global market evolution

- China leads innovation in advanced manufacturing approaches, with companies like CATL and BYD driving CTP and CTC development.

- By 2023, CTP technology achieved 48.6% market penetration in Chinese new energy vehicles, representing rapid transition from traditional approaches.

- Western manufacturers generally lag in adoption, with Ford and GM still primarily using traditional modular approaches.

- However, BMW announced plans to transition to cylindrical battery formats similar to Tesla's approach by 2025, suggesting broader industry movement toward integration.

- Tesla's influence extends beyond their own production, with multiple manufacturers adopting elements of their structural battery approach.

- The success of Model Y with CTC has validated the technology's commercial viability.

Technology maturity timeline

- 2019-2021 marked the emergence of CTP technology, with CATL and BYD launching first-generation systems.

- 2022-2023 saw CTP reach commercial maturity with nearly 50% market adoption in leading markets.

- CTC technology remains in early adoption phases, with only four manufacturers achieving production implementation by 2025.

- However, multiple companies including Volkswagen, Volvo, and SAIC are developing CTC systems for future launch.

- Future projections suggest CTP will maintain 50-60% market share through 2030, while CTC adoption may reach 20-30% as technology matures and costs decline.

- Traditional approaches will likely decline to 30-40% share but maintain importance for specific applications.

Regional manufacturing strategies

- Chinese manufacturers focus on rapid technology advancement and volume production, with substantial government support for battery innovation.

- European manufacturers emphasize gradual transition with strong focus on safety and reliability.

- US manufacturers prioritize supply chain security and domestic production capabilities.

- Investment patterns reflect these strategies, with China leading in CTP/CTC production capacity while the US focuses on building traditional manufacturing capabilities through the Inflation Reduction Act incentives.

Manufacturing complexity and production implications

Production scalability challenges

- Traditional manufacturing achieves proven scalability with mature supply chains and established processes.

- Production rates of 20-30 units per hour are routinely achieved with high reliability.

- CTP manufacturing enables higher automation levels, with some lines achieving over 85% automation and 30+ units per hour.

- The simplified assembly process reduces manufacturing footprint by 20-30% compared to traditional approaches.

- CTC manufacturing faces scalability constraints due to sequential assembly requirements—chassis must be complete before cell installation.

- This creates potential bottlenecks and limits production flexibility.

Equipment and capital requirements

- Investment levels vary significantly between approaches.

- Traditional manufacturing requires €0.6-0.8 million for module assembly equipment plus €1.0 million for pack assembly.

- CTP systems reduce total investment by eliminating module assembly lines.

- CTC systems require the highest specialized equipment investment, including precision robotic placement systems, structural adhesive application equipment, and integrated quality testing systems.

- However, Tesla reports 8% lower unit investment due to simplified overall vehicle structure.

Workforce and skill implications

- Traditional manufacturing relies on established automotive assembly skills with well-understood training requirements.

- CTP manufacturing requires higher automation expertise but reduces overall workforce needs.

- CTC implementation demands highly skilled technicians with expertise in both battery and chassis integration.

- All approaches require comprehensive safety training for high-voltage systems and chemical handling.

Technological convergence

- The industry is converging toward higher integration levels while addressing current limitations.

- Future CTP systems will likely incorporate improved serviceability through clip-on connections and modular design elements.

- CTC technology development focuses on addressing serviceability challenges through improved access design and potentially reversible adhesive systems.

- Advanced thermal management systems using phase-change materials and micro-channel cooling may enable better thermal control in integrated systems.

Industry transformation implications

- The shift toward integration represents more than technological change—it requires fundamental rethinking of vehicle design, manufacturing processes, and service infrastructure.

- Companies successfully navigating this transition will likely gain substantial competitive advantages in the EV market.

- New entrants may benefit from starting with advanced approaches rather than transitioning from traditional methods, as they avoid legacy manufacturing constraints and can design facilities optimized for integrated production.

Global manufacturing distribution and regional strategies

Technology adoption by region shows distinct patterns

- China leads advanced manufacturing approaches with 48.6% of new energy vehicles using CTP technology by 2023, compared to just 13% in 2021.

- Chinese manufacturers like CATL, BYD, and SVOLT have established 460+ GWh of CTP production capacity globally, while pioneering companies like Leapmotor and Xpeng are pushing CTC boundaries.

- European manufacturers generally lag in adoption, with traditional companies like BMW, Mercedes, and Volkswagen still primarily using Module to Pack approaches.

- However, BMW announced significant strategy shifts toward cylindrical battery formats similar to Tesla's approach by 2025, partnering with EVE Energy and CATL for 4680-type cells, suggesting broader European movement toward integration.

- US manufacturers show mixed approaches: Tesla leads with structural battery technology, Ford and GM maintain traditional modular systems for mainstream models, while startups like Rivian and Lucid explore various integration levels depending on market positioning.

- Japanese manufacturers including Toyota, Nissan, and Honda remain heavily focused on Module to Pack approaches, though partnerships with Chinese battery suppliers are gradually introducing CTP capabilities.

Indian manufacturing evolution demonstrates rapid advancement

- India's current distribution shows 70% Module to Pack dominance among established manufacturers, with 25% exploring or implementing Cell to Pack, 3% developing Cell to Chassis concepts, and 2% in experimental or partnership phases.

- This represents dramatic change from 95% M2P dependency just three years ago.

- Government incentives strongly favor integrated approaches through the ₹18,100 crore PLI scheme requiring 60% domestic value addition within five years, effectively mandating more sophisticated manufacturing than simple assembly operations.

- Regional specialization is emerging: Tamil Nadu focuses on two-wheeler CTP applications (Ola Electric), Gujarat emphasizes passenger vehicle integration (Tata Group), Karnataka develops R&D and technology innovation (Exide, XLEX), and Telangana targets component manufacturing (Amara Raja).

Supply chain implications and partnerships

Global supply chain evolution reflects technology shifts

- Traditional supply chains built around M2P manufacturing feature clear separation between cell manufacturers, module assemblers, and pack integrators.

- Companies like Samsung SDI, LG Energy Solution, and CATL supply cells to module manufacturers, who then supply completed modules to automotive OEMs.

- Integrated approaches blur these boundaries, requiring closer collaboration between cell manufacturers and vehicle OEMs.

- Tesla's partnership with Panasonic (M2P era) evolved into direct relationships with CATL (CTP adoption), while BYD's vertical integration from cells through vehicles demonstrates ultimate supply chain control.

- Technology transfer partnerships become crucial for emerging markets. India's growth depends heavily on international partnerships: Tata-Guoxuan, Exide-SVOLT, Ola Electric's independent development, and Ather Energy's indigenous capabilities demonstrate different pathways to technological advancement.

Regional supply chain development shows distinct patterns

- Chinese dominance in battery manufacturing stems from integrated supply chains spanning raw materials through finished vehicles.

- Companies like CATL and BYD control multiple supply chain levels, enabling rapid technology development and cost optimization.

- European response through initiatives like the European Battery Alliance attempts to build integrated supply chains, but remains dependent on Asian suppliers for critical components and raw materials.

- Indian strategy focuses on leveraging international partnerships while building domestic capabilities.

- The PLI scheme's domestic value addition requirements encourage technology transfer rather than simple import substitution.

Future outlook and technology convergence

Technology roadmap suggests continued evolution

- Solid-state batteries may reshape all manufacturing approaches within the next decade.

- These systems have different thermal management, safety, and structural requirements compared to current liquid electrolyte technologies, potentially making current integration approaches obsolete.

- Advanced manufacturing techniques including AI-driven optimization, wireless battery management systems, and reversible adhesive technologies could address current limitations of integrated approaches, particularly serviceability challenges in CTP and CTC systems.

- Recycling considerations will increasingly influence manufacturing approach selection. M2P systems enable easier material recovery, while integrated approaches require sophisticated disassembly processes but may offer better material purity through reduced contamination.

Conclusion: Strategic implications for global manufacturing

- The evolution of battery pack manufacturing techniques reveals fundamental shifts in automotive industry structure, from traditional supplier relationships toward integrated technology partnerships.

- Success in this transformation requires careful balance between technological advancement and practical market requirements, with different regions and manufacturers pursuing distinct strategies based on their capabilities and market positioning.

- Module to Pack approaches will remain relevant for cost-sensitive applications and manufacturers prioritizing flexibility and serviceability.

- These techniques provide proven pathways to market for emerging manufacturers while serving as stepping stones toward more integrated approaches.

- Cell to Pack technology represents the current sweet spot for most manufacturers, offering substantial performance and cost benefits without the extreme complexity of structural integration.

- The commercial success of companies like CATL, BYD, Ola Electric, and Ather Energy demonstrates that CTP approaches can be successfully implemented across different market segments and regions.

- Cell to Chassis integration remains the technological frontier, providing maximum performance benefits for manufacturers willing to invest in complete vehicle platform redesign.

- However, the limited number of successful implementations and ongoing serviceability challenges suggest this approach will remain limited to premium segments and technologically advanced manufacturers

- The global competitive landscape increasingly favors manufacturers who can successfully implement integrated approaches while maintaining cost competitiveness and manufacturing scale.

- Companies like Tesla, BYD, and CATL demonstrate that technological leadership in battery integration translates directly to market advantage and profitability.

- India's emergence as a significant player in global battery manufacturing, demonstrated through companies like Ola Electric, Ather Energy, and traditional manufacturers like Tata and Mahindra, proves that emerging markets can successfully adopt and adapt advanced manufacturing techniques when supported by appropriate policies, international partnerships, and market demand.

- The Indian experience provides valuable lessons for other developing economies seeking to participate in the global transition to electric mobility.\

- The battery manufacturing landscape is experiencing a fundamental transformation that mirrors broader industry shifts toward integration and efficiency.

- The choice between approaches depends critically on specific application requirements, manufacturing capabilities, and market positioning.

- High-volume manufacturers benefit most from CTP technology's production efficiency gains.

- Premium manufacturers may justify CTC complexity for maximum performance differentiation.

- Traditional approaches remain valuable for multi-platform flexibility and established supply chain relationships.

- Future success will likely require portfolio approaches, with manufacturers developing capabilities across multiple technologies rather than committing exclusively to single approaches.

- The industry's continued evolution suggests that today's cutting-edge CTC systems may themselves be replaced by even more integrated approaches as solid-state batteries and other innovations mature.

- For students entering this dynamic field, understanding these manufacturing approaches provides essential foundation knowledge for careers in automotive engineering, battery technology, and electric vehicle development.

- The next decade will likely see continued rapid evolution in these technologies, making ongoing learning and adaptation crucial for professional success in the electric mobility revolution.